The Crucial Role Of Pipe Suppliers

The smooth flow of liquids and gases within industrial, commercial, and residential settings relies heavily on the backbone of any fluid transportation system—pipes. Behind the scenes, pipe supplier Abu Dhabi plays a crucial role in ensuring the integrity, efficiency, and durability of these conduits. This exploration seeks to reveal the multifaceted role of pipe suppliers […]

Continue Reading

Best advices to get cheaper storage units

You will need the facility of self storage in multiple situations but renting them is a huge challenge not in terms of finding a reliable one but in terms of budget. It would be quite expensive in some cases for most of the people so in this article we will address this topic and try […]

Continue Reading

The different career options that you can pursue

If you have completed your intermediate or you have done “A” levels then it can be difficult time of your life. Because this is the time when you will have to choose right career path. But you should choose wisely your profession because your whole life will depend on your decision. For this, you can […]

Continue Reading

Important things to remember while buying furniture

Appropriate selection of furniture is very important as it have a huge impact on an interior. UAE is very famous when it comes to furniture shopping as there are a number of well known outlets present which provide the furniture with best quality and latest design to their customers. Like if someone is willing to […]

Continue Reading

Benefits of indulging children into theater

Theaters are entertaining to watch because it isn’t only the acts and characters but it is the set up which lights up the whole mood, the chaos and anticipation of what goes behind the closed curtains is what keeps its viewers engaged and entertained. Children specifically love to engage in acting and drama classes in […]

Continue Reading

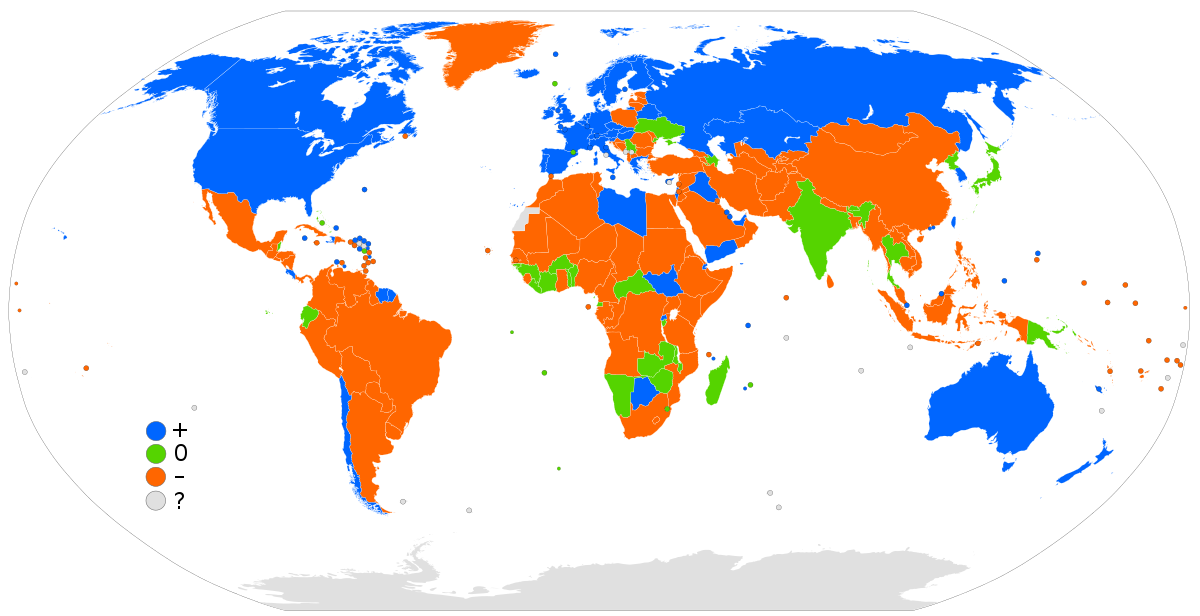

Benefits of immigration to host countries

People are always in search of better options to spend better and quality life. So for this, sometimes they find better income source or sometimes they try to migrate other countries where they can find better life style and better job opportunities. The persons who live in underdeveloped countries try to migrate to developed countries […]

Continue Reading

Don’t Believe the Hype: Debunking Facebook Marketing Myths

There are a lot of myths about Facebook marketing. Some people believe that it’s impossible to get good results without spending a lot of money on ads. Others think that you need to have a huge following in order to be successful. Let us debunk these myths and show you that it is possible to […]

Continue Reading

Things you need to know about oral diseases

We all know that oral health is necessary keep body and mouth healthy. if you don’t do proper care of your mouth then there are several diseases that can occur. Some of these diseases, as mentioned by a clinic of Hollywood smile in Dubai, have been given in this article. Tooth decay: If you don’t […]

Continue Reading

Things to do before establishing your chauffeur services company

We all know that business is always more advantageous than job. You can earn limited amount of money by doing job but you will have to do a lot of struggle in job and then after some years you become able to get some reputable position in your company. But if you are running your […]

Continue Reading

How Car Repairing Services Fix Major Damages Of Your Car

The malfunctions that occur in your car aren’t always automatically happening. These faults usually occur when you’re car isn’t taken care of. But what are those major flaws that stick to your car even when your car is perfectly fine and working? Such harms to your car are usually known as “damages” and these damages […]

Continue Reading